Page 267 - Arvind 2024

P. 267

Corporate Overview Statutory Reports Financial Statements

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

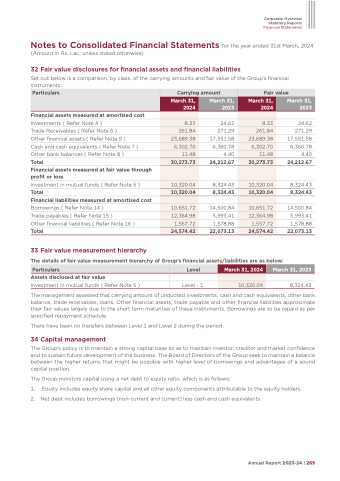

32 Fair value disclosures for financial assets and financial liabilities

Set out below is a comparison, by class, of the carrying amounts and fair value of the Group’s financial instruments:

Particulars

Carrying amount

Fair value

March 31, 2024

March 31, 2023

March 31, 2024

March 31, 2023

8.33

24.62

8.33

261.84

271.29

261.84

23,689.38

6,302.70

17,551.58

6,360.78

23,689.38

6,302.70

11.48

4.40

11.48

30,273.73

24,212.67

30,273.73

10,320.04

10,320.04

8,324.43

8,324.43

10,320.04

10,320.04

10,651.72

14,500.84

10,651.72

12,364.98

5,993.41

12,364.98

1,557.72

24,574.42

1,578.88

22,073.13

1,557.72

24,574.42

Financial assets measured at amortised cost

Investments ( Refer Note 4 )

Trade Receivables ( Refer Note 6 )

Other financial assets ( Refer Note 9 )

Cash and cash equivalents ( Refer Note 7 ) Other bank balances ( Refer Note 8 )

Total

Financial assets measured at fair value through profit or loss

Investment in mutual funds ( Refer Note 5 ) Total

Financial liabilities measured at amortised cost Borrowings ( Refer Note 14 )

Trade payables ( Refer Note 15 )

Other financial liabilities ( Refer Note 16 )

Total

33 Fair value measurement hierarchy

The details of fair value measurement hierarchy of Group’s financial assets/liabilities are as below:

Assets disclosed at fair value

Investment in mutual funds ( Refer Note 5 ) Level - 1

24.62 271.29 17,551.58 6,360.78 4.40 24,212.67

8,324.43

8,324.43

14,500.84 5,993.41 1,578.88

22,073.13

8,324.43

Particulars

The management assessed that carrying amount of unquoted Investments, cash and cash equivalents, other bank balance, trade receivables, loans, Other financial assets, trade payable and other financial liabilities approximate their fair values largely due to the short term maturities of these instruments. Borrowings are to be repaid as per specified repayment schedule

There have been no transfers between Level 1 and Level 2 during the period.

34 Capital management

The Group’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to sustain future development of the business. The Board of Directors of the Group seek to maintain a balance between the higher returns that might be possible with higher level of borrowings and advantages of a sound capital position.

The Group monitors capital using a net debt to equity ratio, which is as follows:

1. Equity includes equity share capital and all other equity components attributable to the equity holders. 2. Net debt includes borrowings (non-current and current) less cash and cash equivalents

Level

March 31, 2024

March 31, 2023

10,320.04

Annual Report 2023-24 | 265