Page 265 - Arvind 2024

P. 265

Corporate Overview Statutory Reports Financial Statements

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

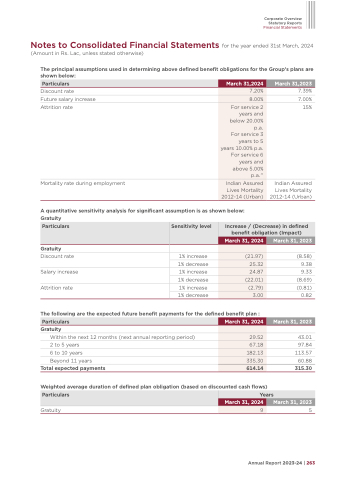

The principal assumptions used in determining above defined benefit obligations for the Group’s plans are shown below:

Particulars

March 31,2024

March 31,2023

7.20%

8.00%

For service 2 years and below 20.00% p.a. For service 3 years to 5 years 10.00% p.a. For service 6 years and above 5.00% p.a."

Indian Assured Lives Mortality 2012-14 (Urban)

Discount rate

Future salary increase Attrition rate

Mortality rate during employment

A quantitative sensitivity analysis for significant assumption is as shown below: Gratuity

7.39% 7.00% 15%

Indian Assured Lives Mortality 2012-14 (Urban)

(8.58) 9.38 9.33 (8.69) (0.81) 0.82

43.01

97.84 113.57 60.88 315.30

5

Particulars

Sensitivity level

Increase / (Decrease) in defined benefit obligation (Impact)

March 31, 2024

March 31, 2023

(21.97)

25.32

24.87

(22.01)

(2.79)

3.00

Gratuity

Discount rate Salary increase Attrition rate

1% increase 1% decrease 1% increase 1% decrease 1% increase 1% decrease

The following are the expected future benefit payments for the defined benefit plan :

Gratuity

Within the next 12 months (next annual reporting period) 2 to 5 years

6 to 10 years

Beyond 11 years

Total expected payments

Weighted average duration of defined plan obligation (based on discounted cash flows)

Gratuity

Particulars

March 31, 2024

March 31, 2023

29.52

67.18

182.13

335.30

614.14

Particulars

Years

March 31, 2024

March 31, 2023

9

Annual Report 2023-24 | 263