Page 268 - Arvind 2024

P. 268

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

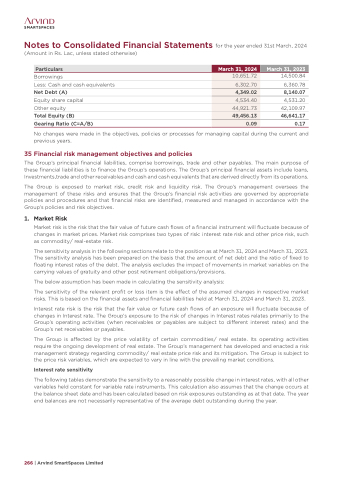

Particulars

March 31, 2023

10,651.72

Borrowings

Less: Cash and cash equivalents Net Debt (A)

Equity share capital

Other equity

Total Equity (B)

Gearing Ratio (C=A/B)

14,500.84 6,360.78 8,140.07 4,531.20

42,109.97

46,641.17 0.17

6,302.70

4,349.02

4,534.40

44,921.73

49,456.13

0.09

No changes were made in the objectives, policies or processes for managing capital during the current and previous years.

35 Financial risk management objectives and policies

The Group’s principal financial liabilities, comprise borrowings, trade and other payables. The main purpose of these financial liabilities is to finance the Group’s operations. The Group’s principal financial assets include loans, Investments,trade and other receivables and cash and cash equivalents that are derived directly from its operations.

The Group is exposed to market risk, credit risk and liquidity risk. The Group’s management oversees the management of these risks and ensures that the Group’s financial risk activities are governed by appropriate policies and procedures and that financial risks are identified, measured and managed in accordance with the Group’s policies and risk objectives.

1. Market Risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises two types of risk: interest rate risk and other price risk, such as commodity/ real-estate risk.

The sensitivity analysis in the following sections relate to the position as at March 31, 2024 and March 31, 2023. The sensitivity analysis has been prepared on the basis that the amount of net debt and the ratio of fixed to floating interest rates of the debt. The analysis excludes the impact of movements in market variables on the carrying values of gratuity and other post retirement obligations/provisions.

The below assumption has been made in calculating the sensitivity analysis:

The sensitivity of the relevant profit or loss item is the effect of the assumed changes in respective market risks. This is based on the financial assets and financial liabilities held at March 31, 2024 and March 31, 2023.

Interest rate risk is the risk that the fair value or future cash flows of an exposure will fluctuate because of changes in Interest rate. The Group’s exposure to the risk of changes in Interest rates relates primarily to the Group’s operating activities (when receivables or payables are subject to different interest rates) and the Group’s net receivables or payables.

The Group is affected by the price volatility of certain commodities/ real estate. Its operating activities require the ongoing development of real estate. The Group’s management has developed and enacted a risk management strategy regarding commodity/ real estate price risk and its mitigation. The Group is subject to the price risk variables, which are expected to vary in line with the prevailing market conditions.

Interest rate sensitivity

The following tables demonstrate the sensitivity to a reasonably possible change in interest rates, with all other variables held constant for variable rate instruments. This calculation also assumes that the change occurs at the balance sheet date and has been calculated based on risk exposures outstanding as at that date. The year end balances are not necessarily representative of the average debt outstanding during the year.

266 | Arvind SmartSpaces Limited

March 31, 2024