Page 269 - Arvind 2024

P. 269

Corporate Overview Statutory Reports Financial Statements

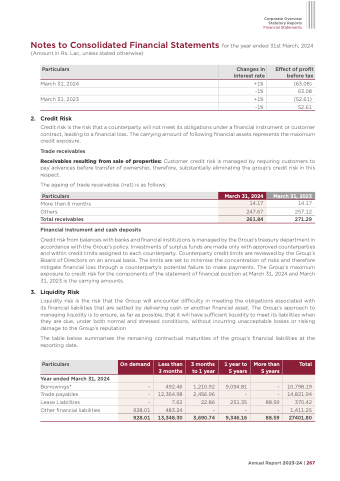

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

Particulars

Changes in interest rate

Effect of profit before tax

March 31, 2024 March 31, 2023

2. Credit Risk

+1% (63.08)

-1% 63.08

+1% (52.61)

-1% 52.61

Credit risk is the risk that a counterparty will not meet its obligations under a financial instrument or customer contract, leading to a financial loss. The carrying amount of following financial assets represents the maximum credit exposure.

Trade receivables

Receivables resulting from sale of properties: Customer credit risk is managed by requiring customers to pay advances before transfer of ownership. therefore, substantially eliminating the group’s credit risk in this respect.

The ageing of trade receivables (net) is as follows:

More than 6 months Others

Total receivables

Financial Instrument and cash deposits

14.17 257.12 271.29

Particulars

Credit risk from balances with banks and financial institutions is managed by the Group’s treasury department in accordance with the Group’s policy. Investments of surplus funds are made only with approved counterparties and within credit limits assigned to each counterparty. Counterparty credit limits are reviewed by the Group’s Board of Directors on an annual basis. The limits are set to minimise the concentration of risks and therefore mitigate financial loss through a counterparty’s potential failure to make payments. The Group’s maximum exposure to credit risk for the components of the statement of financial position at March 31, 2024 and March 31, 2023 is the carrying amounts.

3. Liquidity Risk

Liquidity risk is the risk that the Group will encounter difficulty in meeting the obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. The Group’s approach to managing liquidity is to ensure, as far as possible, that it will have sufficient liquidity to meet its liabilities when they are due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Group‘s reputation

The table below summarises the remaining contractual maturities of the group’s financial liabilities at the reporting date.

Year ended March 31, 2024

Borrowings*

Trade payables

Lease Liabilities

Other financial liabilities

March 31, 2024

March 31, 2023

14.17

247.67

261.84

Particulars

On demand

Less than 3 months

3 months to 1 year

1 year to 5 years

More than 5 years

Total

-

492.46

1,210.92

9,094.81

-

10,798.19

-

12,364.98

2,456.96

-

-

14,821.94

-

7.62

22.86

251.35

88.59

370.42

928.01

928.01

483.24

3,690.74

-

9,346.16

-

88.59

-

1,411.25

13,348.30

27401.80

Annual Report 2023-24 | 267