Page 55 - Arvind 2024

P. 55

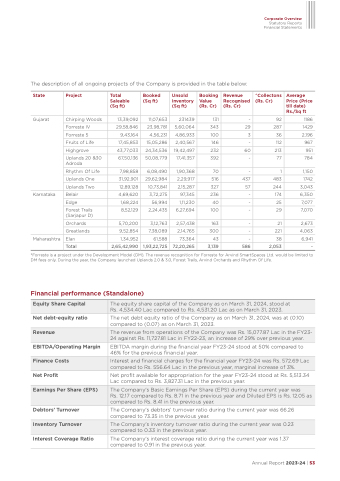

The description of all ongoing projects of the Company is provided in the table below:

Corporate Overview

Statutory Reports Financial Statements

Average Price (Price till date) Rs./Sq ft

92 1186

287 1429

36 2,196

112 967

213 951

77 784

1 1,150

483 1742

244 3,043

174 6,350

25 7,077

29 7,070

21 2,673

221 4,063

38 6,941

2,053 -

Project

Total Saleable (Sq ft)

Booked (Sq ft)

Unsold Inventory (Sq ft)

Booking Value (Rs. Cr)

Revenue Recognised (Rs. Cr)

^Collectons (Rs. Cr)

State

Gujarat

Chirping Woods

Forreste IV

Forreste 5

Fruits of Life

13,39,092

29,58,846

9,43,164

17,45,853

11,07,653

23,98,781

4,56,231

15,05,286

24,34,536

50,08,779

6,08,490

29,62,984

10,73,841

3,72,275

56,994

2,24,435

3,12,763

7,38,089

61,588

231439

5,60,064

4,86,933

2,40,567

19,42,497

17,41,357

1,90,368

2,29,917

2,15,287

97,345

1,11,230

6,27,694

2,57,438

2,14,765

73,364

131 -

343 29

100 3

146 -

232 60

392 -

70 -

516 437

327 57

236 -

40 -

100 -

163 -

300 -

43 -

3,139 586

Highgrove 43,77,033

Uplands 20 &30 Adroda

Rhythm Of Life

Uplands One

Uplands Two

67,50,136

7,98,858

31,92,901

12,89,128

Karnataka

Maharashtra

Belair 4,69,620

Edge 1,68,224

Forest Trails 8,52,129 (Sarjapur D)

Orchards 5,70,200

Greatlands 9,52,854

Elan 1,34,952

Total 2,65,42,990 1,93,22,725 72,20,265

*Forreste is a project under the Development Model (DM). The revenue recognition for Forreste for Arvind SmartSpaces Ltd. would be limited to DM fees only. During the year, the Company launched Uplands 2.0 & 3.0, Forest Trails, Arvind Orchards and Rhythm Of Life.

Financial performance (Standalone)

Equity Share Capital

The equity share capital of the Company as on March 31, 2024, stood at Rs. 4,534.40 Lac compared to Rs. 4,531.20 Lac as on March 31, 2023.

Net debt-equity ratio

EBITDA/Operating Margin

Net Profit

Debtors’ Turnover

Interest Coverage Ratio

The net debt equity ratio of the Company as on March 31, 2024, was at (0.10) compared to (0.07) as on March 31, 2023.

EBITDA margin during the financial year FY23-24 stood at 50% compared to 46% for the previous financial year.

Net profit available for appropriation for the year FY23-24 stood at Rs. 5,513.34 Lac compared to Rs. 3,827.31 Lac in the previous year.

The Company's debtors’ turnover ratio during the current year was 66.26 compared to 73.35 in the previous year.

The Company's interest coverage ratio during the current year was 1.37 compared to 0.91 in the previous year.

Revenue

The revenue from operations of the Company was Rs. 15,077.87 Lac in the FY23- 24 against Rs. 11,727.81 Lac in FY22-23, an increase of 29% over previous year.

Finance Costs

Interest and financial charges for the financial year FY23-24 was Rs. 572.69 Lac compared to Rs. 556.64 Lac in the previous year, marginal increase of 3%.

Earnings Per Share (EPS)

The Company's Basic Earnings Per Share (EPS) during the current year was

Rs. 12.17 compared to Rs. 8.71 in the previous year and Diluted EPS is Rs. 12.05 as compared to Rs. 8.41 in the previous year.

Inventory Turnover

The Company's inventory turnover ratio during the current year was 0.23 compared to 0.33 in the previous year.

Annual Report 2023-24 | 53