Page 54 - Arvind 2024

P. 54

Financial overview

Arvind SmartSpaces and its subsidiaries are primarily engaged in residential segment operating in and around Ahmedabad, Bangalore and Pune market. The Company is currently executing 21 projects through own land, joint ventures and joint development model. The Company successfully executed 12 projects till date, completing ~4.9 Mn sq. ft.

The financial year 2023-24 was

a strong year for the Company marked by highest bookings, collections and new project additions while maintaining a robust Balance Sheet. In FY23-24, ASL registered a booking value

of Rs. 1,107 Cr, a YoY growth of 38%, where the number of units sold stood at 1241 units. Bangalore bookings stood at Rs. 420 Cr, contributing 38% to the total annual bookings. Further, new launches continued to perform well in new micro markets. In FY23-24, ASL launched four projects successfully including Uplands 2.0 & 3.0, Forest Trails, Arvind Orchards and Rhythm

Of Life, which contributed 71% (Rs. 784 Cr) by annual booking value.

Project portfolio

In FY23-24, ASL recorded its highest annual collection of

Rs. 876 Cr, a YoY growth of 46%; highlighting the strong operational cycle of new sales, construction and delivery. During the year, Operating Cash Flows stood at

Rs. 458 Cr as against Rs. 201 Cr last year. The net-debt equity ratio on a consolidated basis as on March 31, 2024 is (0.10) compared to (0.07) as on March 31, 2023. During the year, ASL consolidated revenue from operations grew

by 33% to Rs. 341 Cr and Profit attributable to equity holders increased by 62% to Rs. 41 Cr.

FY23-24 was a historic year for the Company from a project addition perspective with a cumulative

new business development topline potential ~Rs. 4,150 Cr* added during the year. ASL added four projects in Ahmedabad, and one each in Bengaluru and Surat.

In Q1, ASL signed a 500

acre project in NH 47 South Ahmedabad with a revenue potential of ~Rs. 1 450 Cr. This was under 50% revenue share model

In Q1, ASL signed a 204 acre project in Bavla, South Ahmedabad with a revenue

potential of ~Rs. 850 Cr* This was under 55% revenue share model. Projects Uplands 2.0 & 3.0 were successfully launched in Q2

Further, in Q1, ASL signed an agreement with the subsidiary of Arvind Ltd under the Development Management (model to develop a 16-acre township at Moti Bhoyan with a revenue potential of Rs. 116 Cr

In Q2, ASL acquired a new high rise project in Bengaluru with a top line potential of ~Rs. 400 Cr*. The project is spread across 4.3 acre and has a saleable area of 46 Lac sq ft. The project is acquired on an outright basis

In Q3, ASL added new horizontal project in Ahmedabad spread over ~40 acre with a top-line potential of ~Rs. 250* Cr. The Rhythm Of Life project, was successfully launched in Q4

In Q3, ASL entered Surat with a ~Rs. 1 100 Cr horizontal multi asset township project. The project is spread over 300 acres and signed under the joint development model with a 55% revenue share

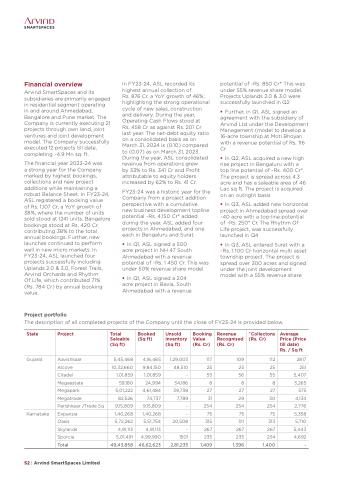

The description of all completed projects of the Company until the close of FY23-24 is provided below.

Project

Total Saleable (Sq ft)

Booked (Sq ft)

Unsold Inventory (Sq ft)

Booking Value (Rs. Cr)

Revenue Recognised (Rs. Cr)

^Collectons (Rs. Cr)

State

Gujarat

Karnataka

Aavishkaar 5,45,468

Alcove 10,32,660

Citadel 1,01,859

Megaestate 59,180

Megapark 5,01,222

Megatrade 82,526

Parishkaar /Trade Sq 9,15,809

Expansia 1,40,268

Oasis 5,72,262

Skylands 4,91,113

Sporcia 5,01,491

Total 49,43,858

4,16,465

9,84,150

1,01,859

24,994

4,61,484

74,737

9,15,809

1,40,268

5,51,754

4,91,113

4,99,990

1,29,003 117

48,510 25

- 55

34,186 8

39,738 27

7,789 31

- 254

- 75

20,508 315

- 267

1501 235

109 112

25 25

56 55

8 8

27 27

29 30

254 254

75 75

311 313

267 267

235 234

Average Price (Price till date) Rs. / Sq ft

2817

251

5,407

3,265

575

4,134

2,776

5,358

5,710

5,443

4,692

46,62,623

2,81,235 1,409

1,396 1,400

-

52 | Arvind SmartSpaces Limited