Page 262 - Arvind 2024

P. 262

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

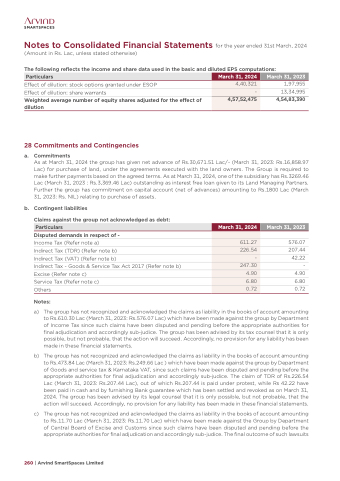

The following reflects the income and share data used in the basic and diluted EPS computations:

Particulars

March 31, 2023

4,40,321

Effect of dilution: stock options granted under ESOP

Effect of dilution: share warrants

Weighted average number of equity shares adjusted for the effect of dilution

28 Commitments and Contingencies

a. Commitments

1,97,955 13,34,995 4,54,83,390

-

4,57,52,475

As at March 31, 2024 the group has given net advance of Rs.30,671.51 Lac/- (March 31, 2023: Rs.16,858.97 Lac) for purchase of land, under the agreements executed with the land owners. The Group is required to make further payments based on the agreed terms. As at March 31, 2024, one of the subsidiary has Rs.3269.46 Lac (March 31, 2023 : Rs.3,369.46 Lac) outstanding as interest free loan given to its Land Managing Partners. Further the group has commitment on capital account (net of advances) amounting to Rs.1800 Lac (March 31, 2023: Rs. NIL) relating to purchase of assets.

b. Contingent liabilities

Claims against the group not acknowledged as debt:

Disputed demands in respect of -

Income Tax (Refer note a)

Indirect Tax (TDR) (Refer note b)

Indirect Tax (VAT) (Refer note b)

Indirect Tax - Goods & Service Tax Act 2017 (Refer note b) Excise (Refer note c)

Service Tax (Refer note c)

Others

Notes:

576.07 207.44 42.22 - 4.90 6.80 0.72

Particulars

March 31, 2024

March 31, 2023

611.27

226.54

-

247.30

4.90

6.80

0.72

a) The group has not recognized and acknowledged the claims as liability in the books of account amounting to Rs.610.30 Lac (March 31, 2023: Rs.576.07 Lac) which have been made against the group by Department of Income Tax since such claims have been disputed and pending before the appropriate authorities for final adjudication and accordingly sub-judice. The group has been advised by its tax counsel that it is only possible, but not probable, that the action will succeed. Accordingly, no provision for any liability has been made in these financial statements.

b) The group has not recognized and acknowledged the claims as liability in the books of account amounting to Rs.473.84 Lac (March 31, 2023: Rs.249.66 Lac ) which have been made against the group by Department of Goods and service tax & Karnataka VAT, since such claims have been disputed and pending before the appropriate authorities for final adjudication and accordingly sub-judice. The claim of TDR of Rs.226.54 Lac (March 31, 2023: Rs.207.44 Lac), out of which Rs.207.44 is paid under protest, while Rs 42.22 have been paid in cash and by furnishing Bank guarantee which has been settled and revoked as on March 31, 2024. The group has been advised by its legal counsel that it is only possible, but not probable, that the action will succeed. Accordingly, no provision for any liability has been made in these financial statements.

c) The group has not recognized and acknowledged the claims as liability in the books of account amounting to Rs.11.70 Lac (March 31, 2023: Rs.11.70 Lac) which have been made against the Group by Department of Central Board of Excise and Customs since such claims have been disputed and pending before the appropriate authorities for final adjudication and accordingly sub-judice. The final outcome of such lawsuits

260 | Arvind SmartSpaces Limited

March 31, 2024