Page 261 - Arvind 2024

P. 261

Corporate Overview Statutory Reports Financial Statements

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

Particulars

Balance sheet

Other comprehensive income

Statement of profit and loss

As at March 31, 2024

As at March 31, 2023

For the year 2023-24

For the year 2022-23

For the year 2023-24

For the year 2022-23

116.59

85.82

11.10

5.72

(19.67)

2,593.61

3,005.26

-

-

411.65

2,710.21

3,091.08

-

-

391.98

-

-

11.10

5.72

401.28

2,651.72

3,041.91

-

-

-

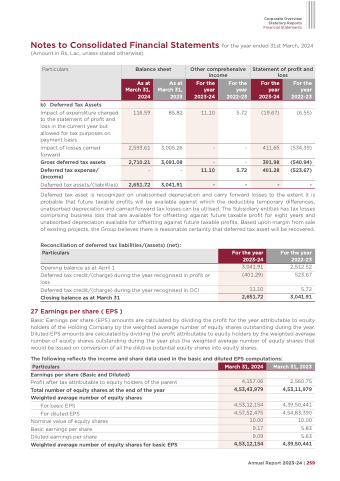

b) Deferred Tax Assets

Impact of expenditure charged to the statement of profit and loss in the current year but allowed for tax purposes on payment basis

Impact of losses carried forward

Gross deferred tax assets Deferred tax expense/ (income)

Deferred tax assets/(liabilities)

(6.55)

(534.39)

(540.94) (523.67)

-

Deferred tax asset is recognized on unabsorbed depreciation and carry forward losses to the extent it is probable that future taxable profits will be available against which the deductible temporary differences, unabsorbed depreciation and carried forward tax losses can be utilised. The Subsidiary entities has tax losses comprising business loss that are available for offsetting against future taxable profit for eight years and unabsorbed depreciation available for offsetting against future taxable profits. Based upon margin from sale of existing projects, the Group believes there is reasonable certainty that deferred tax asset will be recovered.

Reconciliation of deferred tax liabilities/(assets) (net):

Opening balance as at April 1

Deferred tax credit/(charge) during the year recognised in profit or loss

Deferred tax credit/(charge) during the year recognised in OCI Closing balance as at March 31

27 Earnings per share ( EPS )

2,512.52 523.67

5.72

3,041.91

Particulars

For the year 2023-24

For the year 2022-23

3,041.91

(401.29)

11.10

2,651.72

Basic Earnings per share (EPS) amounts are calculated by dividing the profit for the year attributable to equity holders of the Holding Company by the weighted average number of equity shares outstanding during the year. Diluted EPS amounts are calculated by dividing the profit attributable to equity holders by the weighted average number of equity shares outstanding during the year plus the weighted average number of equity shares that would be issued on conversion of all the dilutive potential equity shares into equity shares.

The following reflects the income and share data used in the basic and diluted EPS computations:

Particulars

March 31, 2024

March 31, 2023

Earnings per share (Basic and Diluted)

Profit after tax attributable to equity holders of the parent

Total number of equity shares at the end of the year Weighted average number of equity shares

For basic EPS

For diluted EPS

Nominal value of equity shares

Basic earnings per share

Diluted earnings per share

Weighted average number of equity shares for basic EPS

2,560.75

4,53,11,979

4,39,50,441 4,54,83,390 10.00 5.83 5.63 4,39,50,441

4,157.06

4,53,43,979

4,53,12,154

4,57,52,475

10.00

9.17

9.09

4,53,12,154

Annual Report 2023-24 | 259