Page 260 - Arvind 2024

P. 260

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

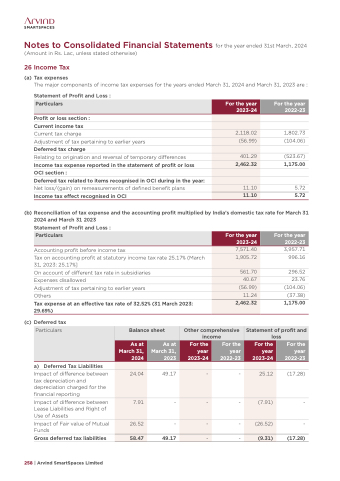

26 Income Tax

(a) Tax expenses

The major components of income tax expenses for the years ended March 31, 2024 and March 31, 2023 are :

Statement of Profit and Loss :

Profit or loss section :

Current income tax

Current tax charge

Adjustment of tax pertaining to earlier years Deferred tax charge

Relating to origination and reversal of temporary differences

Income tax expense reported in the statement of profit or loss OCI section :

Deferred tax related to items recognised in OCI during in the year: Net loss/(gain) on remeasurements of defined benefit plans Income tax effect recognised in OCI

1,802.73 (104.06)

(523.67)

1,175.00

5.72

5.72

Particulars

For the year 2023-24

2,118.02

(56.99)

For the year 2022-23

401.29

2,462.32

11.10

11.10

(b) Reconciliation of tax expense and the accounting profit multiplied by India’s domestic tax rate for March 31 2024 and March 31 2023

Statement of Profit and Loss :

Particulars

For the year 2023-24

1,905.72

561.70

For the year 2022-23

7,571.40

40.67

(56.99)

11.24

2,462.32

Accounting profit before income tax

Tax on accounting profit at statutory income tax rate 25.17% (March 31, 2023: 25.17%]

On account of different tax rate in subsidiaries

Expenses disallowed

Adjustment of tax pertaining to earlier years

Others

Tax expense at an effective tax rate of 32.52% (31 March 2023: 29.69%)

(c) Deferred tax

a) Deferred Tax Liabilities

3,957.71 996.16

296.52 23.76 (104.06) (37.38) 1,175.00

Particulars

Balance sheet

Other comprehensive income

Statement of profit and loss

As at March 31, 2024

As at March 31, 2023

For the year 2023-24

For the year 2022-23

For the year 2023-24

For the year 2022-23

24.04

49.17

-

-

25.12

7.91

-

-

-

(7.91)

26.52

-

-

-

(26.52)

58.47

49.17

-

-

(9.31)

Impact of difference between (17.28) tax depreciation and

depreciation charged for the

financial reporting

Impact of difference between - Lease Liabilities and Right of

Use of Assets

Impact of Fair value of Mutual - Funds

Gross deferred tax liabilities (17.28)

258 | Arvind SmartSpaces Limited