Page 191 - Arvind 2024

P. 191

Corporate Overview Statutory Reports Financial Statements

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

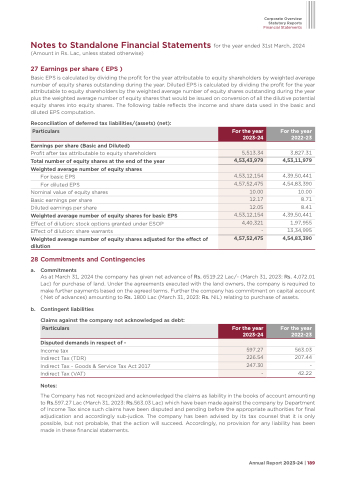

27 Earnings per share ( EPS )

Basic EPS is calculated by dividing the profit for the year attributable to equity shareholders by weighted average number of equity shares outstanding during the year. Diluted EPS is calculated by dividing the profit for the year attributable to equity shareholders by the weighted average number of equity shares outstanding during the year plus the weighted average number of equity shares that would be issued on conversion of all the dilutive potential equity shares into equity shares. The following table reflects the income and share data used in the basic and diluted EPS computation.

Reconciliation of deferred tax liabilities/(assets) (net):

Earnings per share (Basic and Diluted)

Profit after tax attributable to equity shareholders

Total number of equity shares at the end of the year Weighted average number of equity shares

For basic EPS

For diluted EPS

Nominal value of equity shares

Basic earnings per share

Diluted earnings per share

Weighted average number of equity shares for basic EPS

Effect of dilution: stock options granted under ESOP

Effect of dilution: share warrants

Weighted average number of equity shares adjusted for the effect of dilution

28 Commitments and Contingencies

a. Commitments

3,827.31

4,53,11,979

4,39,50,441 4,54,83,390 10.00 8.71 8.41 4,39,50,441 1,97,955 13,34,995 4,54,83,390

Particulars

For the year 2023-24

For the year 2022-23

5,513.34

4,53,43,979

4,53,12,154

4,57,52,475

10.00

12.17

12.05

4,53,12,154

4,40,321

4,57,52,475

-

As at March 31, 2024 the company has given net advance of Rs. 6519.22 Lac/- (March 31, 2023: Rs. 4,072.01 Lac) for purchase of land. Under the agreements executed with the land owners, the company is required to make further payments based on the agreed terms. Further the company has commitment on capital account ( Net of advances) amounting to Rs. 1800 Lac (March 31, 2023: Rs. NIL) relating to purchase of assets.

b. Contingent liabilities

Claims against the company not acknowledged as debt:

Disputed demands in respect of -

Income tax

Indirect Tax (TDR)

Indirect Tax - Goods & Service Tax Act 2017 Indirect Tax (VAT)

Notes:

563.03 207.44 - 42.22

Particulars

For the year 2023-24

For the year 2022-23

597.27

226.54

247.30

-

The Company has not recognized and acknowledged the claims as liability in the books of account amounting to Rs.597.27 Lac (March 31, 2023: Rs.563.03 Lac) which have been made against the company by Department of Income Tax since such claims have been disputed and pending before the appropriate authorities for final adjudication and accordingly sub-judice. The company has been advised by its tax counsel that it is only possible, but not probable, that the action will succeed. Accordingly, no provision for any liability has been made in these financial statements.

Annual Report 2023-24 | 189