Page 190 - Arvind 2024

P. 190

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

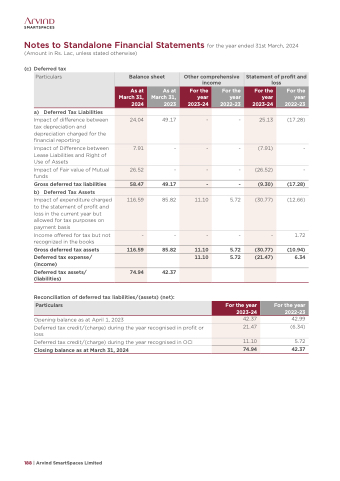

(c) Deferred tax

a) Deferred Tax Liabilities

Impact of difference between (17.28) tax depreciation and

depreciation charged for the

financial reporting

Impact of Difference between - Lease Liabilities and Right of

Use of Assets

Impact of Fair value of Mutual - funds

Gross deferred tax liabilities (17.28)

b) Deferred Tax Assets

Impact of expenditure charged (12.66) to the statement of profit and

loss in the current year but

allowed for tax purposes on

payment basis

Income offered for tax but not 1.72 recognized in the books

Gross deferred tax assets (10.94) Deferred tax expense/ 6.34 (income)

Deferred tax assets/

(liabilities)

Particulars

Balance sheet

Other comprehensive income

Statement of profit and loss

As at March 31, 2024

24.04

As at March 31, 2023

49.17

For the year 2023-24

-

For the year 2022-23

-

For the year 2023-24

25.13

For the year 2022-23

7.91

-

-

-

(7.91)

26.52

-

-

58.47

116.59

49.17

85.82

11.10

-

5.72

-

-

(26.52)

(9.30)

(30.77)

-

-

-

-

-

116.59

74.94

85.82

42.37

11.10

11.10

5.72

5.72

(30.77)

(21.47)

Reconciliation of deferred tax liabilities/(assets) (net):

Opening balance as at April 1, 2023

Deferred tax credit/(charge) during the year recognised in profit or loss

Deferred tax credit/(charge) during the year recognised in OCI Closing balance as at March 31, 2024

42.99 (6.34)

5.72

42.37

Particulars

21.47

For the year 2022-23

42.37

11.10

74.94

188 | Arvind SmartSpaces Limited

For the year 2023-24