Page 189 - Arvind 2024

P. 189

Corporate Overview Statutory Reports Financial Statements

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

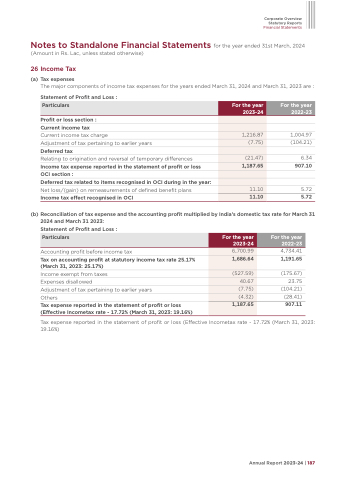

26 Income Tax

(a) Tax expenses

The major components of income tax expenses for the years ended March 31, 2024 and March 31, 2023 are :

Statement of Profit and Loss :

Profit or loss section :

Current income tax

Current income tax charge

Adjustment of tax pertaining to earlier years Deferred tax

Relating to origination and reversal of temporary differences

Income tax expense reported in the statement of profit or loss OCI section :

Deferred tax related to items recognised in OCI during in the year: Net loss/(gain) on remeasurements of defined benefit plans Income tax effect recognised in OCI

1,004.97 (104.21)

6.34

907.10

5.72

5.72

Particulars

For the year 2023-24

1,216.87

(7.75)

For the year 2022-23

(21.47)

1,187.65

11.10

11.10

(b) Reconciliation of tax expense and the accounting profit multiplied by India’s domestic tax rate for March 31 2024 and March 31 2023:

Statement of Profit and Loss :

Particulars

For the year 2023-24

1,686.64

(527.59)

For the year 2022-23

6,700.99

40.67

(7.75)

(4.32)

1,187.65

Accounting profit before income tax

Tax on accounting profit at statutory income tax rate 25.17% (March 31, 2023: 25.17%)

Income exempt from taxes

Expenses disallowed

Adjustment of tax pertaining to earlier years

Others

Tax expense reported in the statement of profit or loss (Effective Incometax rate - 17.72% (March 31, 2023: 19.16%)

4,734.41

1,191.65

(175.67) 23.75 (104.21) (28.41) 907.11

Tax expense reported in the statement of profit or loss (Effective Incometax rate - 17.72% (March 31, 2023: 19.16%)

Annual Report 2023-24 | 187