Page 98 - Arvind 2024

P. 98

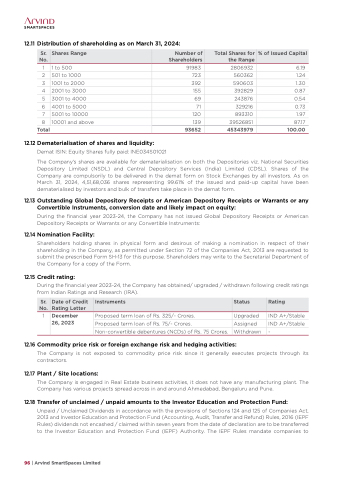

12.11 Distribution of shareholding as on March 31, 2024:

Sr. No.

Shares Range

Number of Shareholders

Total Shares for the Range

% of Issued Capital

1 1 to 500

2 501 to 1000

3 1001 to 2000

4 2001 to 3000

5 3001 to 4000

6 4001 to 5000

7 5001 to 10000

8 10001 and above

Total

12.12 Dematerialisation of shares and liquidity:

Demat ISIN: Equity Shares fully paid: INE034S01021

91983 2806932 6.19

723 560362 1.24

392 590603 1.30

155 392829 0.87

69 243876 0.54

71 329216 0.73

120 893310 1.97

139 39526851 87.17

93652 45343979 100.00

The Company’s shares are available for dematerialisation on both the Depositories viz. National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL). Shares of the Company are compulsorily to be delivered in the demat form on Stock Exchanges by all investors. As on March 31, 2024, 4,51,68,036 shares representing 99.61% of the issued and paid-up capital have been dematerialised by investors and bulk of transfers take place in the demat form.

12.13 Outstanding Global Depository Receipts or American Depository Receipts or Warrants or any Convertible Instruments, conversion date and likely impact on equity:

During the financial year 2023-24, the Company has not issued Global Depository Receipts or American Depository Receipts or Warrants or any Convertible Instruments:

12.14 Nomination Facility:

Shareholders holding shares in physical form and desirous of making a nomination in respect of their shareholding in the Company, as permitted under Section 72 of the Companies Act, 2013 are requested to submit the prescribed Form SH-13 for this purpose. Shareholders may write to the Secretarial Department of the Company for a copy of the Form.

12.15 Credit rating:

During the financial year 2023-24, the Company has obtained/ upgraded / withdrawn following credit ratings from Indian Ratings and Research (IRA).

Sr. No.

Date of Credit Rating Letter

Instruments

Status

Rating

1 December Proposed term loan of Rs. 325/- Crores.

Upgraded

Assigned

Withdrawn

IND A+/Stable

IND A+/Stable

-

26, 2023

Proposed term loan of Rs. 75/- Crores.

Non-convertible debentures (NCDs) of Rs. 75 Crores.

12.16 Commodity price risk or foreign exchange risk and hedging activities:

The Company is not exposed to commodity price risk since it generally executes projects through its contractors.

12.17 Plant / Site locations:

The Company is engaged in Real Estate business activities, it does not have any manufacturing plant. The Company has various projects spread across in and around Ahmedabad, Bengaluru and Pune.

12.18 Transfer of unclaimed / unpaid amounts to the Investor Education and Protection Fund:

Unpaid / Unclaimed Dividends in accordance with the provisions of Sections 124 and 125 of Companies Act, 2013 and Investor Education and Protection Fund (Accounting, Audit, Transfer and Refund) Rules, 2016 (IEPF Rules) dividends not encashed / claimed within seven years from the date of declaration are to be transferred to the Investor Education and Protection Fund (IEPF) Authority. The IEPF Rules mandate companies to

96 | Arvind SmartSpaces Limited