Page 281 - Arvind 2024

P. 281

Corporate Overview Statutory Reports Financial Statements

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

41 Leases

The group has operating lease for labour sheds for 11 months which is renewable on periodic basis as per mutually agreed terms and is cancellable by giving one month notice by either parties. The group has availed the exemption of short term lease for the same. Amount charged to profit and loss account in this regards amounts to Rs 15.32 Lac (March 31, 2023: Rs. 16.22 Lac)

Group as a lessee

The lease liability is initially measured at amortized cost at the present value of the future lease payments on the date of initial application. Right to use assets are initially recognized that is equal to lease liabilities on the initial application date. The group has lease contract for office building at head office-Ahmedabad used for its operations with lease term of 3 years and option of further extension for additional 7 years at the option of lessee. Accordingly, a right-of-use asset of Rs. 82.14 Lac and a corresponding lease liability of Rs. 82.14 Lac has been recognized. The principal portion of the lease payments have been disclosed under cash flow from financing activities. The group’s obligations under its leases are secured by the lessor’s title to the leased assets. The lease contract includes extension and termination options and variable lease payments, which are further discussed below. The group has lease contract for office building at Bangalore used for its operations with lease term of 7 years . Accordingly, a right-of-use asset of Rs. 318.81 Lac and a corresponding lease liability of Rs. 318.81 Lac has been recognized. The principal portion of the lease payments have been disclosed under cash flow from financing activities. The group’s obligations under its leases are secured by the lessor’s title to the leased assets. The lease contract includes extension and termination options and variable lease payments, which are further discussed below.

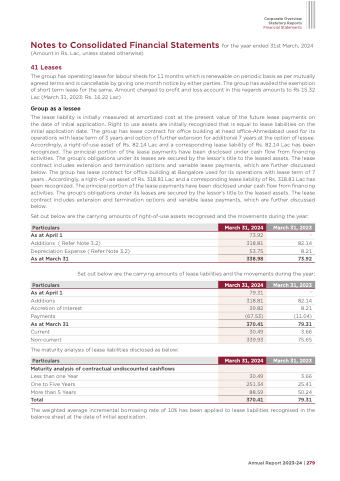

Set out below are the carrying amounts of right-of-use assets recognised and the movements during the year:

Particulars

March 31, 2024

March 31, 2023

As at April 1

Additions ( Refer Note 3.2) Depreciation Expense ( Refer Note 3.2) As at March 31

- 82.14 8.21 73.92

73.92

318.81

53.75

338.98

Set out below are the carrying amounts of lease liabilities and the movements during the year:

Particulars

March 31, 2024

March 31, 2023

As at April 1

Additions

Accretion of interest Payments

As at March 31 Current

Non-current

The maturity analysis of lease liabilities disclosed as below:

Maturity analysis of contractual undiscounted cashflows

Less than one Year One to Five Years More than 5 Years Total

- 82.14

8.21 (11.04) 79.31 3.66 75.65

3.66 25.41 50.24 79.31

79.31

318.81

39.82

(67.53)

370.41

30.49

339.93

Particulars

March 31, 2024

March 31, 2023

30.49

251.34

88.59

370.41

The weighted average incremental borrowing rate of 10% has been applied to lease liabilities recognised in the balance sheet at the date of initial application.

Annual Report 2023-24 | 279