Page 279 - Arvind 2024

P. 279

Corporate Overview Statutory Reports Financial Statements

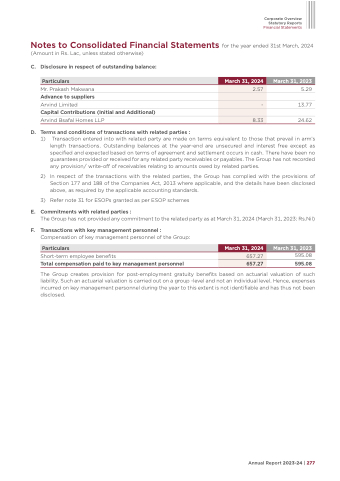

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

C. Disclosure in respect of outstanding balance:

Mr. Prakash Makwana

Advance to suppliers

Arvind Limited

Capital Contributions (Initial and Additional)

Arvind Bsafal Homes LLP

D. Terms and conditions of transactions with related parties :

5.29 13.77 24.62

Particulars

March 31, 2024

March 31, 2023

2.57

-

8.33

1)

2) 3)

Transaction entered into with related party are made on terms equivalent to those that prevail in arm’s length transactions. Outstanding balances at the year-end are unsecured and interest free except as specified and expected based on terms of agreement and settlement occurs in cash. There have been no guarantees provided or received for any related party receivables or payables. The Group has not recorded any provision/ write-off of receivables relating to amounts owed by related parties.

In respect of the transactions with the related parties, the Group has complied with the provisions of Section 177 and 188 of the Companies Act, 2013 where applicable, and the details have been disclosed above, as required by the applicable accounting standards.

Refer note 31 for ESOPs granted as per ESOP schemes

E. Commitments with related parties :

The Group has not provided any commitment to the related party as at March 31, 2024 (March 31, 2023: Rs.Nil)

F. Transactions with key management personnel :

Compensation of key management personnel of the Group: Short-term employee benefits

595.08

Particulars

March 31, 2024

March 31, 2023

657.27

Total compensation paid to key management personnel 595.08

The Group creates provision for post-employment gratuity benefits based on actuarial valuation of such liability. Such an actuarial valuation is carried out on a group -level and not an individual level. Hence, expenses incurred on key management personnel during the year to this extent is not identifiable and has thus not been disclosed.

657.27

Annual Report 2023-24 | 277