Page 201 - Arvind 2024

P. 201

Corporate Overview Statutory Reports Financial Statements

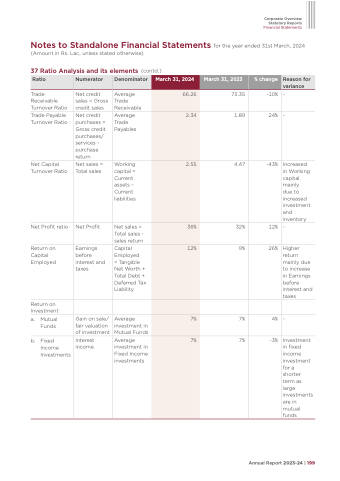

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

37 Ratio Analysis and its elements (contd.)

Trade Receivable Turnover Ratio Trade Payable Turnover Ratio

Net Capital Turnover Ratio

Net Profit ratio

Return on Capital Employed

Return on Investment

a. Mutual Funds

b. Fixed Income

Investments

- -

Increased in Working capital mainly

due to increased investment and inventory

-

Higher return mainly due to increase in Earnings before interest and taxes

-

Investment in fixed income investment for a shorter term as large investments are in mutual funds

Ratio

Numerator

Denominator

March 31, 2024

66.26

March 31, 2023

73.35

% change

Reason for variance

Net credit sales = Gross credit sales

Average Trade Receivable

-10%

Net credit purchases = Gross credit purchases/ services - purchase return

Average Trade Payables

2.34

1.89

24%

Net sales = Total sales

Working capital = Current assets – Current liabilities

2.55

4.47

-43%

Net Profit

Net sales = Total sales - sales return

36%

32%

12%

Earnings before interest and taxes

Capital Employed

= Tangible Net Worth + Total Debt + Deferred Tax Liability

12%

9%

26%

Gain on sale/ fair valuation of investment

Average investment in Mutual Funds

7%

7%

4%

Interest income

Average investment in Fixed Income investments

7%

7%

-3%

Annual Report 2023-24 | 199