Page 200 - Arvind 2024

P. 200

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

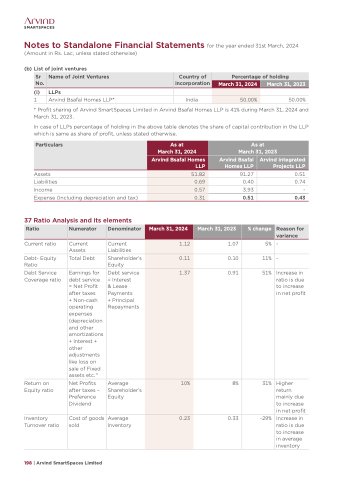

(b) List of joint ventures

(i) LLPs

1 Arvind Bsafal Homes LLP* India 50.00%

* Profit sharing of Arvind SmartSpaces Limited in Arvind Bsafal Homes LLP is 41% during March 31, 2024 and March 31, 2023.

In case of LLPs percentage of holding in the above table denotes the share of capital contribution in the LLP which is same as share of profit, unless stated otherwise.

Sr No.

Name of Joint Ventures

Country of incorporation

Percentage of holding

March 31, 2024

March 31, 2023

50.00%

Particulars

As at March 31, 2024

Arvind Bsafal Homes LLP

As at March 31, 2023

Arvind Bsafal Homes LLP

Arvind Integrated Projects LLP

51.82

0.69

0.57

0.31

Assets 91.27

Liabilities 0.40

Income 3.93

0.51

0.74

-

0.43

Increase in ratio is due to increase in net profit

Expense (Including depreciation and tax)

37 Ratio Analysis and its elements

0.51

Ratio

Numerator

Denominator

March 31, 2024

March 31, 2023

% change

Reason for variance

Current Assets

Current Liabilities

1.12

1.07 5%

0.11

Earnings for debt service = Net Profit after taxes

+ Non-cash operating expenses (depreciation and other amortizations + Interest + other adjustments like loss on sale of Fixed assets etc."

Debt service = Interest

& Lease Payments

+ Principal Repayments

1.37

0.91

51%

Net Profits after taxes – Preference Dividend

Average Shareholder’s Equity

10%

8%

31%

Cost of goods sold

Average Inventory

0.23

0.33

-29%

Current ratio

Debt- Equity Ratio

Debt Service Coverage ratio

Total Debt

Shareholder’s Equity

0.10

11%

-

-

Return on Equity ratio

Inventory Turnover ratio

Higher return mainly due to increase in net profit Increase in ratio is due to increase in average inventory

198 | Arvind SmartSpaces Limited