Page 86 - Arvind 2024

P. 86

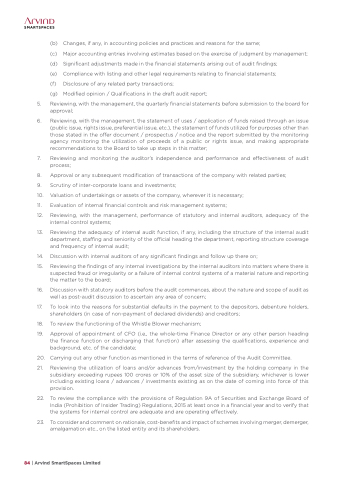

(b) Changes, if any, in accounting policies and practices and reasons for the same;

(c) Major accounting entries involving estimates based on the exercise of judgment by management;

(d) Significant adjustments made in the financial statements arising out of audit findings;

(e) Compliance with listing and other legal requirements relating to financial statements;

(f) Disclosure of any related party transactions;

(g) Modified opinion / Qualifications in the draft audit report;

5. Reviewing, with the management, the quarterly financial statements before submission to the board for approval;

6. Reviewing, with the management, the statement of uses / application of funds raised through an issue (public issue, rights issue, preferential issue, etc.), the statement of funds utilized for purposes other than those stated in the offer document / prospectus / notice and the report submitted by the monitoring agency monitoring the utilization of proceeds of a public or rights issue, and making appropriate recommendations to the Board to take up steps in this matter;

7. Reviewing and monitoring the auditor’s independence and performance and effectiveness of audit process;

8. Approval or any subsequent modification of transactions of the company with related parties;

9. Scrutiny of inter-corporate loans and investments;

10. Valuation of undertakings or assets of the company, wherever it is necessary;

11. Evaluation of internal financial controls and risk management systems;

12. Reviewing, with the management, performance of statutory and internal auditors, adequacy of the internal control systems;

13. Reviewing the adequacy of internal audit function, if any, including the structure of the internal audit department, staffing and seniority of the official heading the department, reporting structure coverage and frequency of internal audit;

14. Discussion with internal auditors of any significant findings and follow up there on;

15. Reviewing the findings of any internal investigations by the internal auditors into matters where there is suspected fraud or irregularity or a failure of internal control systems of a material nature and reporting the matter to the board;

16. Discussion with statutory auditors before the audit commences, about the nature and scope of audit as well as post-audit discussion to ascertain any area of concern;

17. To look into the reasons for substantial defaults in the payment to the depositors, debenture holders, shareholders (in case of non-payment of declared dividends) and creditors;

18. To review the functioning of the Whistle Blower mechanism;

19. Approval of appointment of CFO (i.e., the whole-time Finance Director or any other person heading the finance function or discharging that function) after assessing the qualifications, experience and background, etc. of the candidate;

20. Carrying out any other function as mentioned in the terms of reference of the Audit Committee.

21. Reviewing the utilization of loans and/or advances from/investment by the holding company in the subsidiary exceeding rupees 100 crores or 10% of the asset size of the subsidiary, whichever is lower including existing loans / advances / investments existing as on the date of coming into force of this provision.

22. To review the compliance with the provisions of Regulation 9A of Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015 at least once in a financial year and to verify that the systems for internal control are adequate and are operating effectively.

23. To consider and comment on rationale, cost-benefits and impact of schemes involving merger, demerger, amalgamation etc., on the listed entity and its shareholders.

84 | Arvind SmartSpaces Limited