Page 251 - Arvind 2024

P. 251

Corporate Overview Statutory Reports Financial Statements

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

Share based payment reserve

The share options based payment reserve is used to recognise the grant date fair value of options issued to employees under Employee stock option plan.

Retained Earnings

The cumulative gain or loss arising from the operations which is retained by the group is recognised and accumulated under the head of retained earnings.

Capital Reserve

Capital reserve on consolidation represents excess of fair value of net assets acquired over consideration paid.

Distribution Proposed

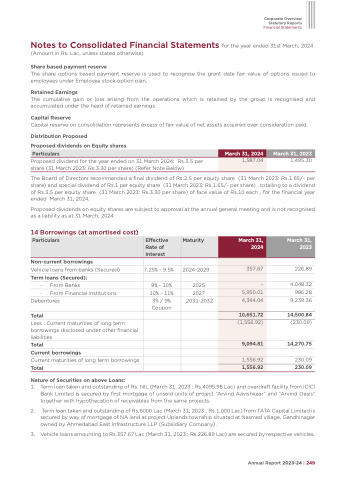

Proposed dividends on Equity shares

Proposed dividend for the year ended on 31 March 2024: Rs.3.5 per share (31 March 2023: Rs.3.30 per share) (Refer Note Below)

1,495.30

Particulars

March 31, 2024

March 31, 2023

1,587.04

The Board of Directors recommended a final dividend of Rs.2.5 per equity share (31 March 2023: Rs.1.65/- per share) and special dividend of Rs.1 per equity share (31 March 2023: Rs.1.65/- per share) , totalling to a dividend of Rs.3.5 per equity share (31 March 2023: Rs.3.30 per share) of face value of Rs.10 each , for the financial year ended March 31, 2024.

Proposed dividends on equity shares are subject to approval at the annual general meeting and is not recognised as a liability as at 31 March, 2024.

14 Borrowings (at amortised cost)

Non-current borrowings

Vehicle loans from banks (Secured)

Term loans (Secured):

- From Banks

- From Financial institutions

Debentures

Total

Less : Current maturities of long term borrowings disclosed under other financial liabilities

Total

Current borrowings

Current maturities of long term borrowings

Total

Nature of Securities on above Loans:

7.25% - 9.5%

2024-2029

226.89

4,048.32 986.28 9,239.36

14,500.84

(230.09)

14,270.75

230.09

230.09

Particulars

Effective Rate of Interest

Maturity

March 31, 2024

March 31, 2023

357.67

5,950.01

-

4,344.04

10,651.72

(1,556.92)

9,094.81

1,556.92

1,556.92

9% - 10% 2025

10% - 11% 2027

3% / 9% Coupon

2031-2032

1. 2. 3.

Term loan taken and outstanding of Rs. NIL (March 31, 2023 : Rs.4095.98 Lac) and overdraft facility from ICICI Bank Limited is secured by first mortgage of unsold units of project “Arvind Aavishkaar” and “Arvind Oasis” together with hypothecation of receivables from the same projects.

Term loan taken and outstanding of Rs.6000 Lac (March 31, 2023 : Rs.1,000 Lac) from TATA Capital Limited is secured by way of mortgage of NA land at project Uplands township situated at Nasmed village, Gandhinagar owned by Ahmedabad East Infrastructure LLP (Subsidiary Company).

Vehicle loans amounting to Rs.357.67 Lac (March 31, 2023 : Rs.226.89 Lac) are secured by respective vehicles.

Annual Report 2023-24 | 249