Page 245 - Arvind 2024

P. 245

Corporate Overview Statutory Reports Financial Statements

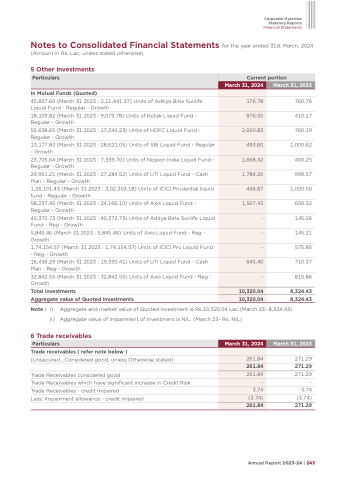

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

5 Other Investments

In Mutual Funds (Quoted)

45,837.60 (March 31 2023 : 2,11,441.37) Units of Aditya Birla Sunlife Liquid Fund - Regular - Growth

18,109.82 (March 31 2023 : 9,079.78) Units of Kotak Liquid Fund - Regular - Growth

56,638.65 (March 31 2023 : 17,340.23) Units of HDFC Liquid Fund - Regular - Growth

13,177.83 (March 31 2023 : 28,621.05) Units of SBI Liquid Fund - Regular - Growth

23,705.64 (March 31 2023 : 7,339.70) Units of Nippon India Liquid Fund - Regular - Growth

29,951.21 (March 31 2023 : 27,284.52) Units of UTI Liquid Fund - Cash Plan - Regular - Growth

1,26,101.43 (March 31 2023 : 3,02,303.18) Units of ICICI Prudential liquid fund - Regular - Growth

58,237.45 (March 31 2023 : 24,166.10) Units of Axis Liquid Fund - Regular - Growth

40,372.73 (March 31 2023 : 40,372.73) Units of Aditya Birla Sunlife Liquid Fund - Reg - Growth

5,845.46 (March 31 2023 : 5,845.46) Units of Axis Liquid Fund - Reg - Growth

1,74,154.57 (March 31 2023 : 1,74,154.57) Units of ICICI Pru Liquid Fund - Reg - Growth

16,436.29 (March 31 2023 : 19,390.41) Units of UTI Liquid Fund - Cash Plan - Reg - Growth

32,842.55 (March 31 2023 : 32,842.55) Units of Axis Liquid Fund - Reg - Growth

Total investments

Aggregate value of Quoted investments

760.76 410.17 760.19

1,000.62

400.25

999.57

1,000.00

600.32

145.26

145.21

575.85

710.37

815.86

8,324.43 8,324.43

Particulars

March 31, 2024

Current portion

176.78

March 31, 2023

876.50

2,660.83

493.60

1,668.42

1,784.20

446.87

1,567.43

-

-

-

645.40

-

10,320.04

10,320.04

Note : i) Aggregate and market value of Quoted investment is Rs.10,320.04 Lac.(March 23- 8,324.43) ii) Aggregate value of impairment of Investment is NIL. (March 23- Rs. NIL)

6 Trade receivables

Trade receivables ( refer note below )

(Unsecured , Considered good, unless Otherwise stated)

Trade Receivables considered good

Trade Receivables which have significant increase in Credit Risk Trade Receivables - credit impaired

Less: Impairment allowance - credit impaired

271.29

271.29

271.29 - 3.74 (3.74) 271.29

Particulars

March 31, 2024

March 31, 2023

261.84

261.84

261.84

-

3.74

(3.74)

261.84

Annual Report 2023-24 | 243