Page 240 - Arvind 2024

P. 240

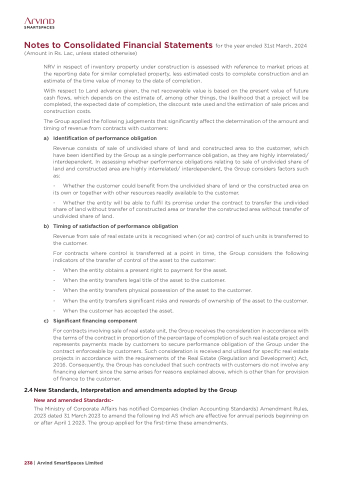

Notes to Consolidated Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

NRV in respect of inventory property under construction is assessed with reference to market prices at the reporting date for similar completed property, less estimated costs to complete construction and an estimate of the time value of money to the date of completion.

With respect to Land advance given, the net recoverable value is based on the present value of future cash flows, which depends on the estimate of, among other things, the likelihood that a project will be completed, the expected date of completion, the discount rate used and the estimation of sale prices and construction costs.

The Group applied the following judgements that significantly affect the determination of the amount and timing of revenue from contracts with customers:

a) Identification of performance obligation

Revenue consists of sale of undivided share of land and constructed area to the customer, which have been identified by the Group as a single performance obligation, as they are highly interrelated/ interdependent. In assessing whether performance obligations relating to sale of undivided share of land and constructed area are highly interrelated/ interdependent, the Group considers factors such as:

- Whether the customer could benefit from the undivided share of land or the constructed area on its own or together with other resources readily available to the customer.

- Whether the entity will be able to fulfil its promise under the contract to transfer the undivided share of land without transfer of constructed area or transfer the constructed area without transfer of undivided share of land.

b) Timing of satisfaction of performance obligation

Revenue from sale of real estate units is recognised when (or as) control of such units is transferred to the customer.

For contracts where control is transferred at a point in time, the Group considers the following indicators of the transfer of control of the asset to the customer:

- When the entity obtains a present right to payment for the asset.

- When the entity transfers legal title of the asset to the customer.

- When the entity transfers physical possession of the asset to the customer.

- When the entity transfers significant risks and rewards of ownership of the asset to the customer.

- When the customer has accepted the asset.

c) Significant financing component

For contracts involving sale of real estate unit, the Group receives the consideration in accordance with the terms of the contract in proportion of the percentage of completion of such real estate project and represents payments made by customers to secure performance obligation of the Group under the contract enforceable by customers. Such consideration is received and utilised for specific real estate projects in accordance with the requirements of the Real Estate (Regulation and Development) Act, 2016. Consequently, the Group has concluded that such contracts with customers do not involve any financing element since the same arises for reasons explained above, which is other than for provision of finance to the customer.

2.4 New Standards, Interpretation and amendments adopted by the Group

New and amended Standards:-

The Ministry of Corporate Affairs has notified Companies (Indian Accounting Standards) Amendment Rules, 2023 dated 31 March 2023 to amend the following Ind AS which are effective for annual periods beginning on or after April 1 2023. The group applied for the first-time these amendments.

238 | Arvind SmartSpaces Limited