Page 209 - Arvind 2024

P. 209

Corporate Overview Statutory Reports Financial Statements

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

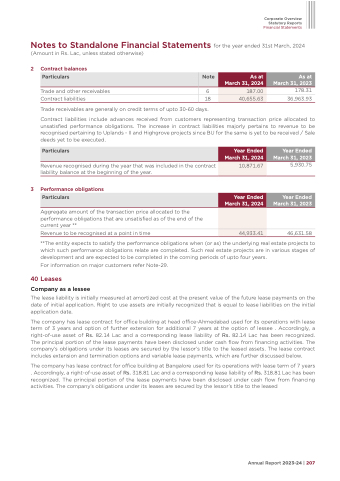

2 Contract balances

Particulars

178.31 Contract liabilities 18 36,963.93

Trade and other receivables 6

Trade receivables are generally on credit terms of upto 30-60 days.

Contract liabilities include advances received from customers representing transaction price allocated to unsatisfied performance obligations. The increase in contract liabilities majorly pertains to revenue to be recognised pertaining to Uplands - II and Highgrove projects since BU for the same is yet to be received / Sale deeds yet to be executed.

Particulars

Revenue recognised during the year that was included in the contract liability balance at the beginning of the year.

3 Performance obligations

Aggregate amount of the transaction price allocated to the performance obligations that are unsatisfied as of the end of the current year **

Revenue to be recognised at a point in time

5,930.75

46,631.58

Note

As at March 31, 2024

As at March 31, 2023

187.00

40,655.63

Year Ended March 31, 2024

Year Ended March 31, 2023

10,871.67

Particulars

Year Ended March 31, 2024

Year Ended March 31, 2023

44,933.41

**The entity expects to satisfy the performance obligations when (or as) the underlying real estate projects to which such performance obligations relate are completed. Such real estate projects are in various stages of development and are expected to be completed in the coming periods of upto four years.

For information on major customers refer Note-29.

40 Leases

Company as a lessee

The lease liability is initially measured at amortized cost at the present value of the future lease payments on the date of initial application. Right to use assets are initially recognized that is equal to lease liabilities on the initial application date.

The company has lease contract for office building at head office-Ahmedabad used for its operations with lease term of 3 years and option of further extension for additional 7 years at the option of lessee . Accordingly, a right-of-use asset of Rs. 82.14 Lac and a corresponding lease liability of Rs. 82.14 Lac has been recognized. The principal portion of the lease payments have been disclosed under cash flow from financing activities. The company’s obligations under its leases are secured by the lessor’s title to the leased assets. The lease contract includes extension and termination options and variable lease payments, which are further discussed below.

The company has lease contract for office building at Bangalore used for its operations with lease term of 7 years . Accordingly, a right-of-use asset of Rs. 318.81 Lac and a corresponding lease liability of Rs. 318.81 Lac has been recognized. The principal portion of the lease payments have been disclosed under cash flow from financing activities. The company’s obligations under its leases are secured by the lessor’s title to the leased

Annual Report 2023-24 | 207