Page 180 - Arvind 2024

P. 180

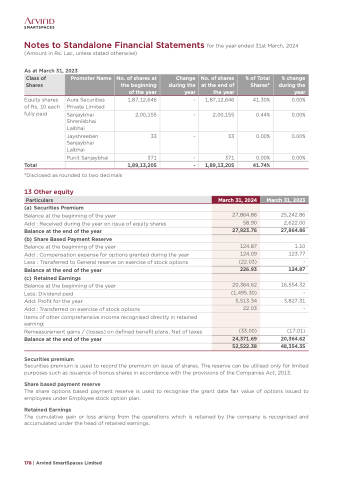

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

As at March 31, 2023

Class of Shares

Promoter Name

No. of shares at the beginning of the year

Change during the year

No. of shares at the end of the year

% of Total Shares*

% change during the year

Equity shares of Rs. 10 each fully paid

Total

Aura Securities Private Limited

Punit Sanjaybhai

1,87,12,646

371

1,89,13,205

- 1,87,12,646

- 371

- 1,89,13,205

41.30%

0.00%

41.74%

0.00% 0.00%

0.00% 0.00%

25,242.86 2,622.00 27,864.86

1.10 123.77 - 124.87

16,554.32 - 3,827.31 -

(17.01)

20,364.62 48,354.35

Sanjaybhai Shrenikbhai Lalbhai

2,00,155

-

2,00,155

0.44%

Jayshreeben Sanjaybhai Lalbhai

33

-

33

0.00%

*Disclosed as rounded to two decimals

13 Other equity

(a) Securities Premium

Particulars

March 31, 2024

124.09

March 31, 2023

27,864.86

58.90

27,923.76

124.87

(22.03)

226.93

20,364.62

(1,495.30)

5,513.34

22.03

(33.00)

24,371.69

52,522.38

Balance at the beginning of the year

Add : Received during the year on issue of equity shares

Balance at the end of the year

(b) Share Based Payment Reserve

Balance at the beginning of the year

Add : Compensation expense for options granted during the year

Less : Transferred to General reserve on exercise of stock options Balance at the end of the year

(c) Retained Earnings

Balance at the beginning of the year

Less: Dividend paid

Add: Profit for the year

Add : Transferred on exercise of stock options

Items of other comprehensive income recognised directly in retained earning:

Remeasurement gains / (losses) on defined benefit plans, Net of taxes Balance at the end of the year

Securities premium

Securities premium is used to record the premium on issue of shares. The reserve can be utilised only for limited purposes such as issuance of bonus shares in accordance with the provisions of the Companies Act, 2013.

Share based payment reserve

The share options based payment reserve is used to recognise the grant date fair value of options issued to employees under Employee stock option plan.

Retained Earnings

The cumulative gain or loss arising from the operations which is retained by the company is recognised and accumulated under the head of retained earnings.

178 | Arvind SmartSpaces Limited