Page 172 - Arvind 2024

P. 172

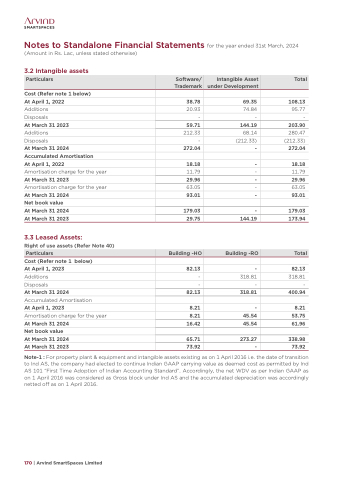

Notes to Standalone Financial Statements for the year ended 31st March, 2024 (Amount in Rs. Lac, unless stated otherwise)

3.2 Intangible assets

Cost (Refer note 1 below)

At April 1, 2022 38.78

Additions 20.93

Disposals -

At March 31 2023 59.71

Additions 212.33

Disposals -

69.35 108.13

74.84 95.77

- -

144.19 203.90

68.14 280.47

(212.33) (212.33)

- 272.04

- 18.18

- 11.79

- 29.96

- 63.05

- 93.01

- 179.03

144.19 173.94

- 82.13

318.81 318.81

- -

318.81 400.94

- 8.21

45.54 53.75

45.54 61.96

273.27 338.98

- 73.92

Particulars

Software/ Trademark

Intangible Asset under Development

Total

At March 31 2024

Accumulated Amortisation

At April 1, 2022

Amortisation charge for the year

At March 31 2023

Amortisation charge for the year

At March 31 2024

Net book value At March 31 2024 At March 31 2023

3.3 Leased Assets:

Right of use assets (Refer Note 40)

Cost (Refer note 1 below)

At April 1, 2023

Additions

Disposals

At March 31 2024

Accumulated Amortisation

At April 1, 2023

Amortisation charge for the year

At March 31 2024 Net book value At March 31 2024 At March 31 2023

272.04

18.18

11.79

29.96

63.05

93.01

179.03

29.75

82.13

-

-

82.13

8.21

8.21

16.42

65.71

73.92

Particulars

Building -HO

Building -RO

Total

Note-1 : For property plant & equipment and intangible assets existing as on 1 April 2016 i.e. the date of transition to Ind AS, the company had elected to continue Indian GAAP carrying value as deemed cost as permitted by Ind AS 101 “First Time Adoption of Indian Accounting Standard”. Accordingly, the net WDV as per Indian GAAP as on 1 April 2016 was considered as Gross block under Ind AS and the accumulated depreciation was accordingly netted off as on 1 April 2016.

170 | Arvind SmartSpaces Limited