Page 149 - Arvind 2024

P. 149

Corporate Overview Statutory Reports Financial Statements

(e) There were no loans or advance in the nature of loan granted to companies, firms, Limited liability partnership or any other parties which had fallen due during the year as these have not been demanded during the year.

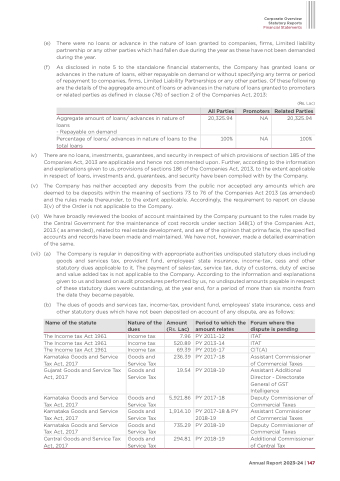

(f) As disclosed in note 5 to the standalone financial statements, the Company has granted loans or advances in the nature of loans, either repayable on demand or without specifying any terms or period of repayment to companies, firms, Limited Liability Partnerships or any other parties. Of these following are the details of the aggregate amount of loans or advances in the nature of loans granted to promoters or related parties as defined in clause (76) of section 2 of the Companies Act, 2013:

Aggregate amount of loans/ advances in nature of loans

- Repayable on demand

Percentage of loans/ advances in nature of loans to the total loans

(Rs. Lac) 20,325.94

100% NA 100%

All Parties

Promoters

Related Parties

20,325.94

NA

iv) There are no loans, investments, guarantees, and security in respect of which provisions of section 185 of the Companies Act, 2013 are applicable and hence not commented upon. Further, according to the information and explanations given to us, provisions of sections 186 of the Companies Act, 2013, to the extent applicable in respect of loans, investments and, guarantees, and security have been complied with by the Company.

(v) The Company has neither accepted any deposits from the public nor accepted any amounts which are deemed to be deposits within the meaning of sections 73 to 76 of the Companies Act 2013 (as amended) and the rules made thereunder, to the extent applicable. Accordingly, the requirement to report on clause 3(v) of the Order is not applicable to the Company.

(vi) We have broadly reviewed the books of account maintained by the Company pursuant to the rules made by the Central Government for the maintenance of cost records under section 148(1) of the Companies Act, 2013 ( as amended), related to real estate development, and are of the opinion that prima facie, the specified accounts and records have been made and maintained. We have not, however, made a detailed examination of the same.

(vii) (a)

The Company is regular in depositing with appropriate authorities undisputed statutory dues including goods and services tax, provident fund, employees’ state insurance, income-tax, cess and other statutory dues applicable to it. The payment of sales-tax, service tax, duty of customs, duty of excise and value added tax is not applicable to the Company. According to the information and explanations given to us and based on audit procedures performed by us, no undisputed amounts payable in respect of these statutory dues were outstanding, at the year end, for a period of more than six months from the date they became payable.

(b) The dues of goods and services tax, income-tax, provident fund, employees’ state insurance, cess and other statutory dues which have not been deposited on account of any dispute, are as follows:

Name of the statute

Nature of the dues

Amount (Rs. Lac)

Period to which the amount relates

Forum where the dispute is pending

The Income tax Act 1961

The Income tax Act 1961

The Income tax Act 1961

Karnataka Goods and Service Tax Act, 2017

Gujarat Goods and Service Tax Act, 2017

Karnataka Goods and Service Tax Act, 2017

Karnataka Goods and Service Tax Act, 2017

Karnataka Goods and Service Tax Act, 2017

Central Goods and Service Tax Act, 2017

Income tax

Income tax

Income tax

Goods and Service Tax

Goods and Service Tax

Goods and Service Tax

Goods and Service Tax

Goods and Service Tax

7.96 PY 2011-12

520.89 PY 2013-14

69.39 PY 2016-17

236.39 PY 2017-18

5,921.86 PY 2017-18

1,914.10 PY 2017-18 2018-19

735.29 PY 2018-19 294.81 PY 2018-19

& PY

ITAT

ITAT

CIT(A)

Assistant Commissioner of Commercial Taxes Assistant Additional Director - Directorate General of GST Intelligence

Deputy Commissioner of Commercial Taxes

Assistant Commissioner of Commercial Taxes

Deputy Commissioner of Commercial Taxes Additional Commissioner of Central Tax

Goods and Service Tax

19.54

PY 2018-19

Annual Report 2023-24 | 147